Duties on the import of aluminum and alloys: the position of the Italian industry in the sector

In view of the review of the Duty Regulation, the Italian light metal industrial chain believes that the rules currently in force represent a fully valid point of balance that can be shared and maintained.

The Italian aluminum industry has always expressed itself clearly regarding the need for Europe to be equipped with an integrated and complete light metal industrial value chain. This condition is fundamental for the full development of the supply chain, to allow it to adequately respond to current and future market needs, in particular looking at the digital, energy and environmental transition objectives that our continent has set for 2030 and 2050.

In summary, it is essential for Europe to have a solid aluminum industry in all its aspects, starting from the production of primary metal, passing through the transformation into semi-finished products, arriving at the final processes and concluding with the recovery and recycling process of metal, increasingly essential.

From this perspective, one of the aspects of particular interest to consider is that relating to the duties for the import of aluminum currently in force. This is a "hot" topic, in particular considering the expiry of the terms of the previous agreement: the conditions established in the 2012 agreement, in fact, already extended in 2016 and confirmed again until 2022, should now remain unchanged according to the Assomet associates and the members of EA - European Aluminium, the reference association for the sector at continental level.

Specifically this would include:

- maintaining the duty on unalloyed raw aluminum at 3% (customs code 7601 10);

- maintaining the duty on alloy aluminum for plates and billets at 4% (customs codes 7601 20 30 and 7601 20 40);

- the maintenance of the duty on alloyed aluminum for alloyed bread at 6% (customs code 7601 20 80).

The Italian industry and aluminum import duties

In view of the review of the agreement, it is useful to state that the position of the Italian aluminum industry with respect to the tariff issue has not changed. The system currently in place, in fact, is still recognized as a point of balance between different needs. It is certain, in fact, that the abolition of duties on aluminum imports would put the survival of European production of both primary and recycled metal at risk. Even more so today, with the Critical

Raw Material Act would like a Europe that is less dependent on raw material imports and even more virtuous in recycling. And let's not forget that for every ton of production lost in Europe, climate-altering gas emissions into the atmosphere increase since the vast majority of non-EU production uses energy sources deriving from the massive use of fossil fuels.

Changing the tariff regime today would mean limiting our internal potential by subjecting ourselves to the importation of material with a high carbon footprint, thus eliminating the results of the policies that Europe is implementing in terms of environmental sustainability and circular economy. The structural relaunch of the aluminum sector today involves other issues, such as:

- The decarbonisation of transport;

- The recovery of end uses (automotive and construction above all others);

- The protection of companies at risk of relocation;

- The defense and development of recycling activities.

The strong geopolitical tensions underway have led to a reconsideration of globalization as understood to date; decoupling is the response given by Europe to the supply chains of industrial transformation, with the relocalization of strategic productions and/or their rapprochement in more stable areas. European industry plays in the market with the same rules for everyone, without distortions.

The competitiveness of productions dedicated to export outside the EU is guaranteed by Inward Processing, which allows you not to pay import duties into the EU for productions that are then re-exported. But, finally wanting to consider how much the duty really affects typical aluminum products such as windows and cars, it turns out that it is a few euros considering that a large part of the metal used comes from recycling. On a car costing €20-30,000, containing around 200 kg of aluminium, this is a few euro cents per kilogram, around ten euros in total.

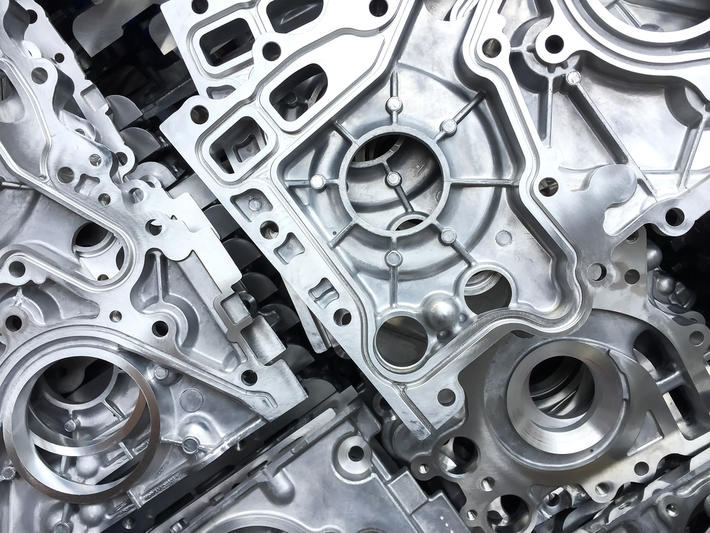

Source: A&L Aluminium Alloys Pressure Diecasting Foundry Tecniques